IFRS S1 und IFRS S2

Specification of the sustainability reporting

In November 2021, the IASB - the International Accounting Standards Board - established a body specializing in sustainability reporting. The ISSB - International Sustainability Standards Board - has the task of specifying corporate reporting on environmental issues. The ISSB delivered in June 2023 and published the first IFRS SDS standards, IFRS S1 and IFRS S2. In future, these regulations will define the general guidelines and specific reporting content.

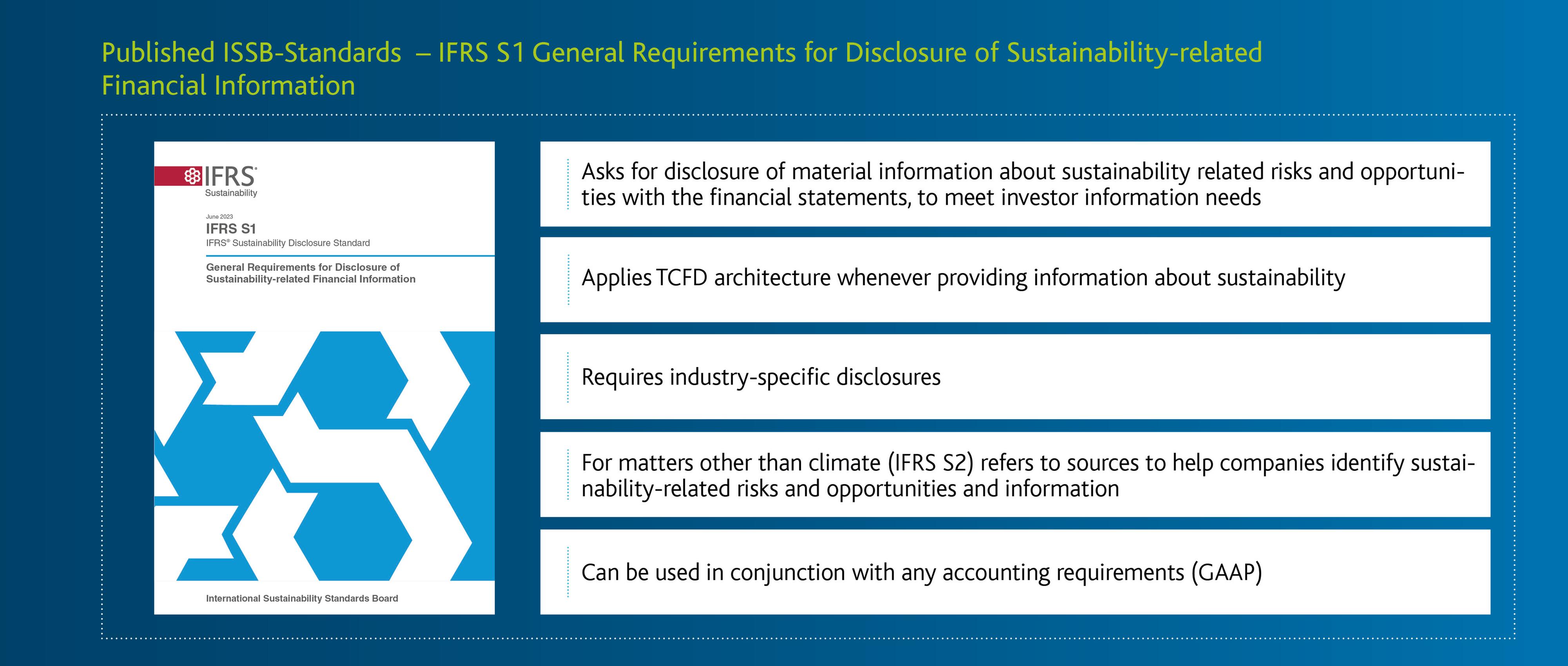

IFRS S1: General Requirements for the Disclosure of Financial Information on Sustainability

As early as the 2024 financial year, capital market-oriented groups will be required by IFRS S1 to publish certain sustainability information. So IFRS reporters need to hurry.

The focus of the IFRS S1 regulations is on information that is currently and in the future related to sustainability-related risks and opportunities - and is thus useful to financial statement readers when making decisions about the provision of resources for the company, e.g. investment and/or financing calculations.

Since the cash flows generated by the company are decisive for its valuation and future viability, their dependencies on sustainability-related resources should primarily be disclosed.

IFRS S1 thus requires publicly traded groups to disclose information about all sustainability-related risks and opportunities that have the potential to affect the entity's short-, medium- or long-term cash flows, access to finance or cost of capital.

This information must be integrated into the financial reporting in a prominent place, e.g. in the management report or the MD&A, and must be provided for the first time for financial years beginning on 1 January 2024. However, the ISSB has been lenient and has suspended the obligation to disclose comparative figures for the previous year as a start-up measure for the first-time disclosure.

The content of the new reporting modules focuses on process-related reporting on governance, corporate strategy, risk management and key figures as well as corporate objectives, which is oriented towards the value creation process of the company.

Here, the workload may not be fairly distributed: Single-product companies with a strong focus on a universal manufacturing process or a manageable portfolio of suppliers and customers can certainly reduce the reporting complexity significantly compared to heterogeneously structured conglomerates.

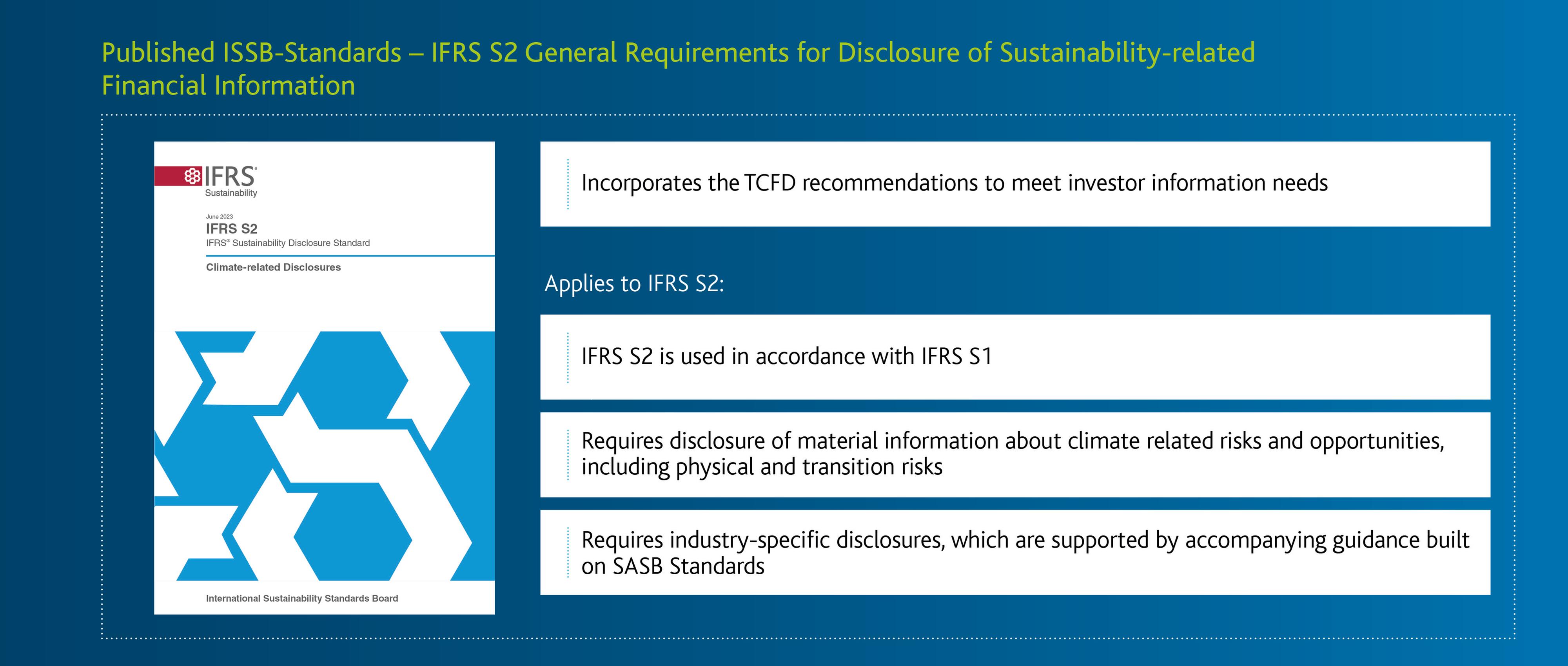

IFRS S2: Climate-Related Disclosure

The second module of the currently published IFRS SDSs focuses on the concrete content of environmental reporting.

The focus is consequently on all existing risks and opportunities from business activities with environmental relevance and those that will result from transformation developments.

About the reporting components codified in IFRS S1 (governance, strategy, risk management, and objectives), more extensive requirements are formulated in IFRS S2.

Here, too, the ISSB has provided for simplifications in the context of the first-time application and allows, for example, established procedures of the CO2 footprint calculation if these deviate from the legislative definitions.

IOSCO: International ESG Convergence through Acceptance of IFRS S1 & IFRS S2

The disclosures on sustainability reporting formulated by the ISSB and ISAB in Europe were upgraded globally at the end of July 2023. IOSCO - The International Organization of Securities Commissions - the international umbrella organization of stock exchange supervisory authorities - has officially recognized the SDSs and recommended its members to include these regulations in their frameworks for integrated capital market reporting. This strong signal will strengthen international ESG convergence in the long term and create planning security for all affected and globally active corporations.

IFRS Sustainability Disclosure Taxonomy

The IASB took an important next step in July 2023 to establish integrated environmental reporting in companies' digital reporting platforms. The ISSB has now made the finalized taxonomy, again based on XBRL, available at the end of April 2024.

The ISSB taxonomy is intended to enable readers of financial statements to use sustainability-related financial disclosures for analytical purposes. According to the IASB, the taxonomy was developed to support the dialog between companies and investors. It does not introduce any new regulations and has no influence on a company's compliance with the ISSB standards. Nevertheless, companies can offer holistic digital reporting for the capital market, as the sustainability taxonomy is consistent with the IFRS accounting taxonomy.

Do Capital Market-Oriented Companies Really Get Implementation Security?

As early as 20 years ago, IOSCO, whose 130 member countries claim to cover more than 95% of global capital market trading, advised its members to apply IFRS standards. As a further essential step on this roadmap for increased reporting convergence, the application recommendation for the IFRS SDS has now also been issued. Other measures on the highway for more deeply integrated financial and non-financial reporting will certainly follow.

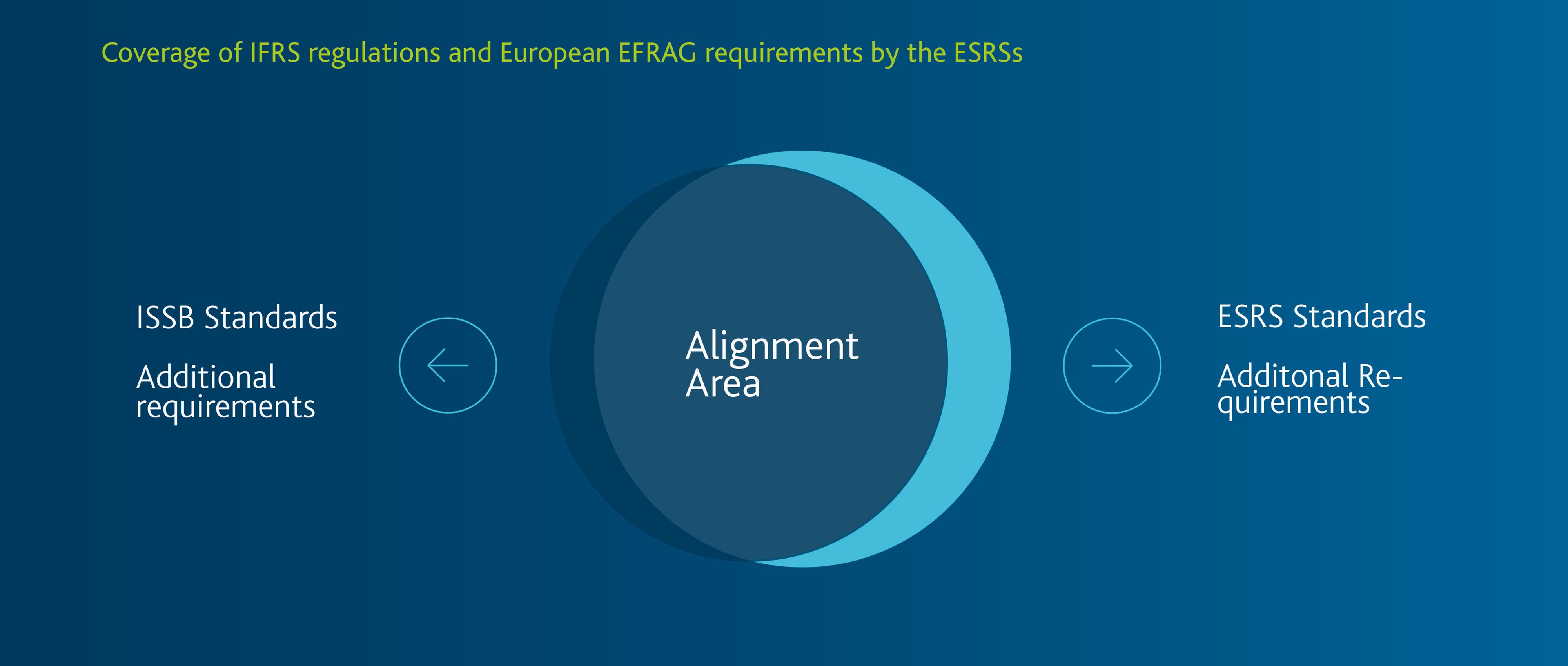

The coexistence of IASB standards, ESRSs and pronouncements of the Global Reporting Initiative (GRI) does not necessarily lead to increased implementation security on the part of companies - parallel reporting may even lead to an unintended increase in complexity. It is true that the new ISSB pronouncements "cover" the current SASB and TCFD guidelines. However, there are differences in the regulations from London and Brussels, which will certainly be discussed by the financial community in the coming months. In any case, the duplications in the reporting obligation, the differences to be interpreted and the burdens resulting from the first-time application will lead to noticeable additional expense, particularly for internationally active corporate groups.

It is true that capital market-oriented groups are practiced in ESG implementation in accordance with NFRD, CSRD and Pillar II and will certainly welcome the "plus" in terms of implementation security that has now been gained. Software manufacturers, such as the German company SAP, have already positioned themselves with the cloud application Group Reporting Data Collection in the SAP S/4HANA context and also offer ESG templates for integrated reporting. With strategic foresight, companies should already focus on the most manageable effort possible for rule reporting in implementation projects at the time of initial implementation.

Written by

Prof. Dr. Martin Wünsch is an expert in financial reporting and SAP S/4Hana Finance Consulting. He is familiar with this field from various perspectives, e.g., Big4-Audit, Corporate Functions, or Management Consulting. He holds a chair in Business Administration, in particular in Int, Accounting & Controlling, at the FOM University of Applied Sciences Düsseldorf and regularly publishes on current topics in financial reporting.