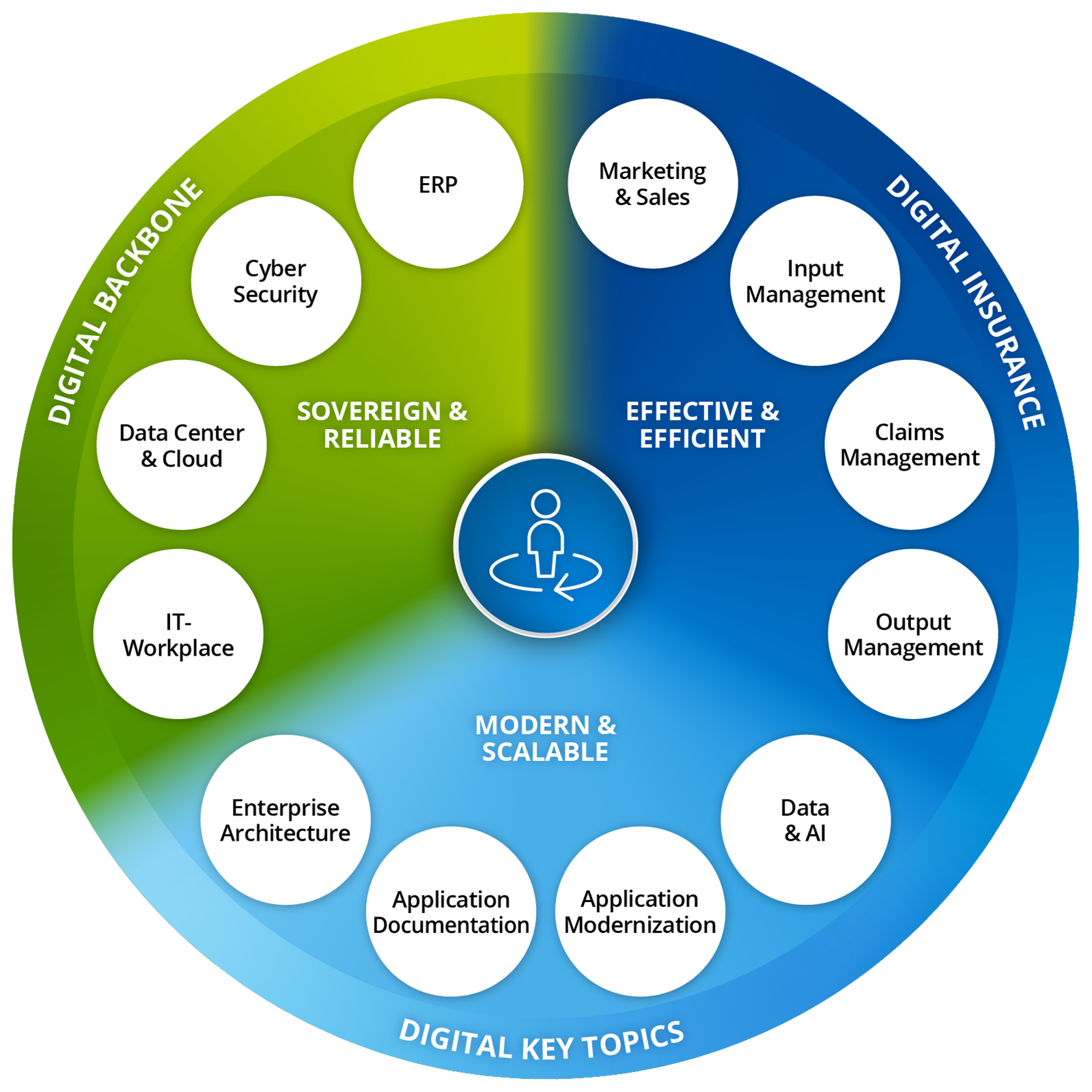

Digitization Partner for Insurers and Financial Service Providers

Sovereign, modern and scalable: our digital solutions for insurers and financial service providers

Insurers and financial service providers are under enormous pressure to transform: demographic change exacerbates the shortage of skilled workers, while operating costs are rising due to outdated technology stacks. At the same time, competitive pressure is growing from purely digital providers who operate with lean structures and a high rate of innovation.

To effectively counter this, scalable, secure, and intelligent solutions are needed – technologically modern and compliant with regulations. This is precisely where we come in: with many years of industry experience in developing digital solutions such as the German insurance industry's information and notification system (HIS), secure operation from German data centres, and the stability of a financially strong group.

Digital Transformation in the Insurance and Financial Sector. Insurance Companies and Banks Face Growing Pressure to Digitize. Our service portfolio empowers financial institutions and insurances to unlock the full potential of digitalization and remain competitive in the face of rising challenges from digital-native providers.

Our Services

"For me, digitalization and technology are decisive factors in the financial sector. End customers' expectations for personalized and user-friendly insurance and financial solutions require the integration of modern technologies. We anticipate the changing end customer needs and offer our customers innovative technological solutions to provide their end customers with a first-class customer experience. We Empower Digital Leaders."

Our Certificates

You can rely on us when it comes to information security, quality management and IT service management. We regularly subject our services to intensive evaluation and undergo comprehensive certification. By strictly adhering to the highest quality standards and our advanced technological expertise, you benefit in the long term from a trusting and extremely professional working relationship. Below you will find some selected certifications, Further information is available here.

-

ISAE 3402 Type 2

International Standard on Assurance Engagements 3402

We are happy to provide proof of certification at the customer's request.

-

ISO/IEC 27001: 2022

Information Security Management System

Holder of the certificate: Bertelsmann SE & Co. KGaA with the organizational units/locations as listed in the annex. An audit, documented in a report, provided evidence that the management system fulfills the requirements of the regulations.

To the document -

ISO 22301: 2019

Business Continuity Management System

Holder of the certificate: Arvato Systems GmbH

Through an audit, documented in a report, proof was provided that the management system fulfills the requirements of the regulations.

To the document -

ISO 9001: 2015

Part of the certified management system of the Bertelsmann SE & Co. KGaA organization

Holder of the confirmation of the re-certification procedure for Arvato Systems GmbH and Arvato Systems Digital GmbH

To the document -

DIN EN 506000 | Data center facilities and infrastructures

System evaluation and compliance with regulations

TÜV South

To the document -

BSI C5 Type2

Secure cloud computing according to BSI

This certificate confirms the operational effectiveness of the security measures for cloud services (Arvato Systems VPC, AWS, Microsoft Azure and Google Cloud). We are happy to provide proof of certification upon customer request.

-

ISO/IEC 22237

System evaluation and conformity with standards

Extract from Our Customer Projects

Things to Know (FAQ)

-

How is compliance with regulatory requirements ensured?

In regulated industries, compliance with legal and regulatory requirements is essential. For regulated companies such as financial service providers, it is therefore of central importance to have a reliable IT service provider at their side who is familiar with the implementation of regulatory requirements.

As Arvato Systems, we have implemented an organizational structure and processes that support the fulfillment of regulatory requirements in areas such as data protection, information security, compliance, risk management and auditing. Thanks to extensive certifications, we are ideally positioned as a reliable and efficient IT service provider and regularly have this claim confirmed by independent auditors. We support you in drafting contracts in accordance with the specifications and enable you to control and monitor your outsourcing. This enables you to appropriately identify, assess and manage all risks associated with your outsourced activities and processes.

-

What are the challenges facing the financial sector and how can digitalization and automation help?

The financial sector is faced with the challenge of constantly expanding its business while at the same time minimizing risks and sustainably reducing costs. Financial customers today demand fast, transparent and customer-oriented processing across different channels. Digitalization and automation of processes is the solution to lowering costs, reducing processing times in terms of quality and counteracting the challenges of demographic change - and and without making major and expensive changes to the IT architecture. The focus should be on standardized, repetitive processes with high administrative costs, such as claims settlement, payment processes, sales planning or input and output management.

-

How can software be renewed on outdated components?

In principle, there are various options for replacing old software components. The most costly option is a complete new build, in which the software component is designed and implemented from scratch. Another form of software renewal is a largely technical migration of the component. In this case, the functional processes are retained and the software is moved to a new technical basis. Which variant is the right one must be considered and decided individually in each case, as there are advantages and disadvantages to be considered for each solution.

-

Why should insurance and financial services companies use a hybrid cloud?

A hybrid cloud offers insurance and financial services companies the opportunity to take advantage of the benefits of public clouds - such as scalability, cost-efficient use of resources and state-of-the-art infrastructure technologies. At the same time, applications with personal and/or business-critical data can be operated, stored and archived in private cloud environments in compliance with data protection regulations.

Arvato Systems is an infrastructure-independent managed service provider. This means that Arvato Systems has a standardized managed service portfolio, which is based on the infrastructures of Azure, AWS and GCP as well as on the infrastructure of the Arvato Systems virtual private cloud - the Virtual Private Cloud - can be operated. Arvato Systems is therefore the ideal managed service provider for companies that want a hybrid cloud want to use a hybrid cloud.

Your Contact for Insurance & Financial Services