We Get You up and Running With SAP DRC

E-Invoicing becomes mandatory

E-Invoicing: Efficient Implementation of Legal Requirements with SAP DRC

With SAP DRC, you can efficiently implement legal requirements for electronic invoicing (E-Document) with legal certainty. We support you in complying with reporting obligations and the timely transmission of tax-relevant reports to national and international tax authorities, whether by email, via Peppol, or through government portals. Our solutions are optimally tailored to SAP S/4HANA and enable compliance in all relevant countries.

The legal requirements in Germany, the EU, and worldwide are changing rapidly. Companies face the challenge of continually adapting to new digital requirements for e-invoicing. With the gradual introduction of mandatory e-invoicing and increasing reporting obligations, a future-proof, scalable solution is essential.

SAP Document and Reporting Compliance (DRC) offers comprehensive functions for tax compliance, automated reporting, and the management of legally required documents in Germany and abroad. Companies can use it to process e-invoices and other documents efficiently, integrate reporting, and transmit country-specific reports directly from SAP S/4HANA to the relevant tax authorities.

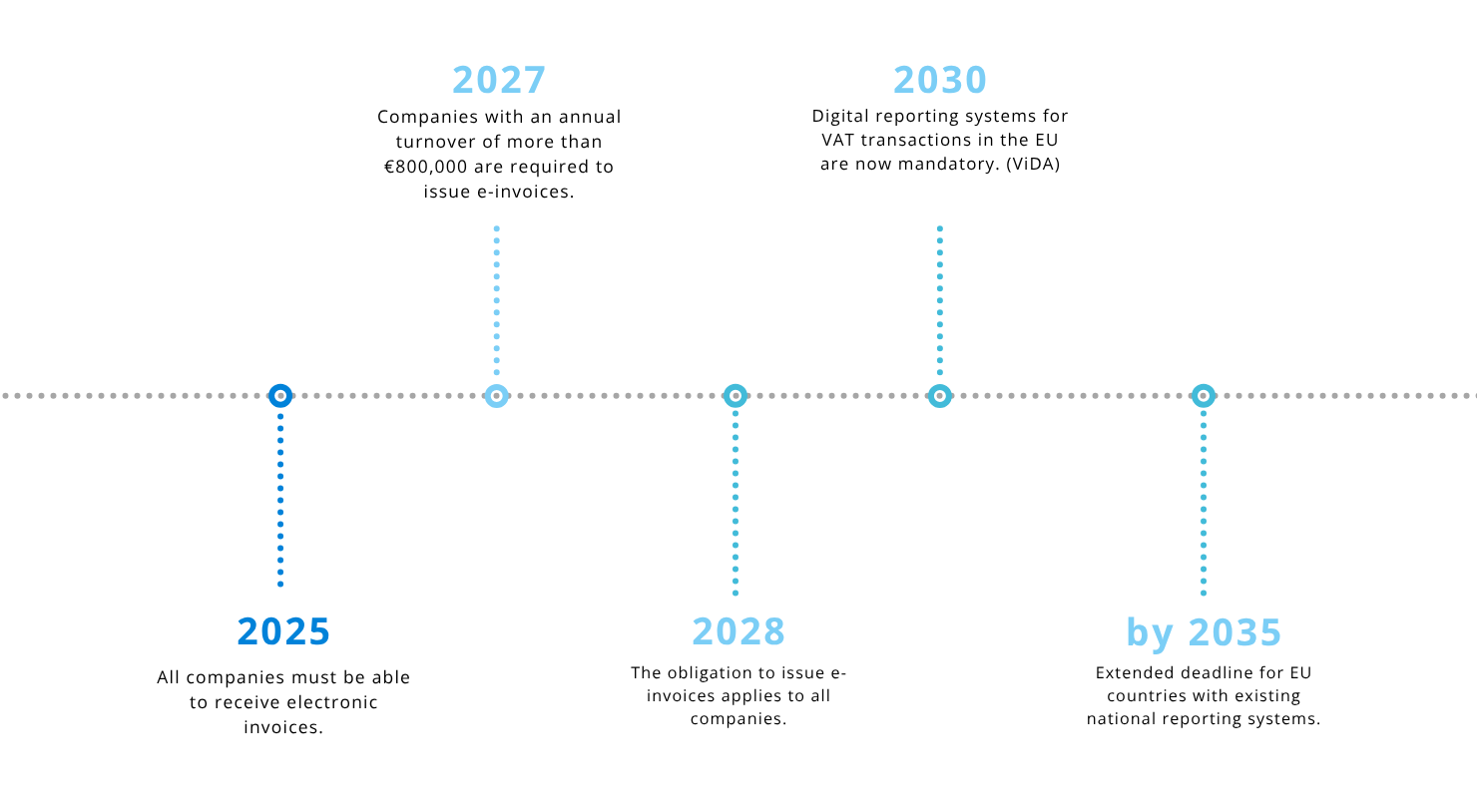

Timetable for e-bills in Germany

From January 1, 2025, companies in Germany will be obliged to receive and process electronic invoices in a structured format. From 2027, this obligation will then apply across the board - including in the B2B sector.

Companies must prepare early in order to be fully compliant on time. The requirements are complex and include:

- Country-specific regulations and formats

- Technical connection to portals such as Peppol, ZRE and OZG-RE

- Peppol: An international network standard for the electronic exchange of invoices and orders, especially in the public sector

- ZRE (Central invoice receipt platform of the Federal Government): Portal for submitting electronic invoices to federal authorities in Germany

- OZG-RE (Online Access Act Invoice Receipt Platform): Portal for the transmission of electronic invoices to authorities of the federal states and municipalities

- Seamless integration of e-invoicing processes into ERP systems with central DRC functions for automation and compliance

- Legally compliant monitoring, error handling and supplementary reporting for compliance with current reporting obligations

Stay Legally Compliant and Capable of Acting with SAP DRC

In addition to electronic invoicing, topics such as reporting and tax reporting are increasingly coming into focus - with SAP DRC you remain legally compliant and able to act.

SAP Document and Reporting Compliance (DRC) is SAP's central solution for complying with legal requirements in the area of electronic document transmission. The solution offers comprehensive functions for the automated processing and transmission of e-invoices (edocuments) and tax reports - efficiently, legally compliant and directly from the SAP system.

Companies worldwide use SAP DRC to reliably implement country-specific regulations and formats - both within the EU and internationally. Central monitoring, integrated error handling and transparent reports enable error-free compliance.

Avoid Risks - Start Implementing SAP DRC Now

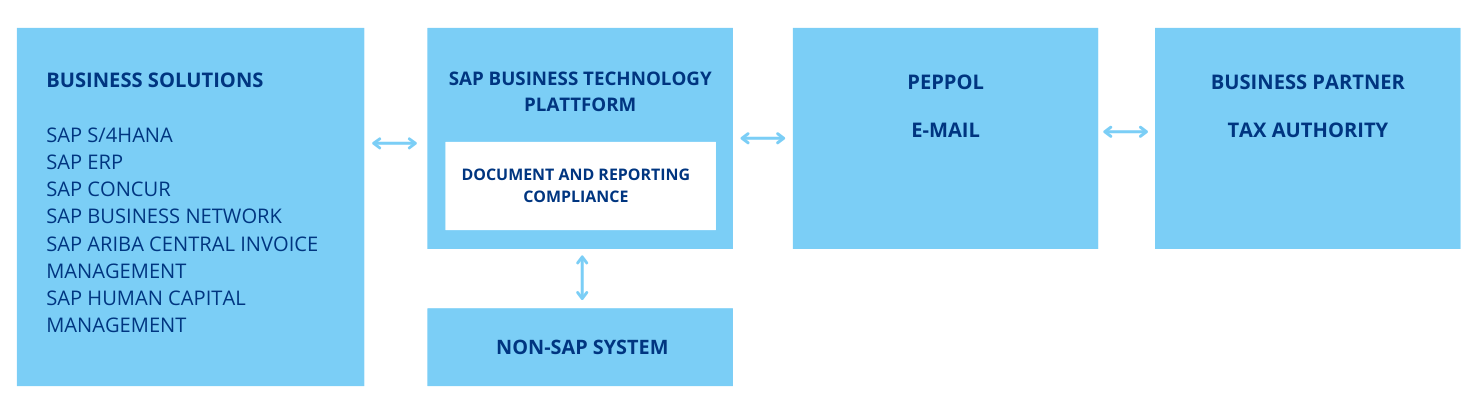

SAP Document and Reporting Compliance (DRC) can be seamlessly integrated into a wide range of SAP solutions - including SAP S/4HANA. This close connection enables end-to-end processing of business data and electronic invoices as well as efficient implementation of reporting obligations and legal requirements - all from one central system.

SAP DRC Supports Companies With

- Centralized management of e-invoices, tax notifications and reporting obligations worldwide

- Automated creation, validation and transmission of legally required documents and reports

- Seamless integration into SAP S/4HANA and ERP processes without additional system breaks

- Direct connection to national platforms such as Peppol, ZRE, OZG-RE and others

- Intuitive user interface (UI) for simple operation and fast implementation

- Real-time transparency with dashboards, KPIs and reporting functions for monitoring status, errors and deadlines

- Legal certainty and quick adaptability to new legal requirements thanks to central updates by SAP

- Future-proof thanks to flexible expandability for new countries, formats and reporting requirements

Electronic Invoice Exchange

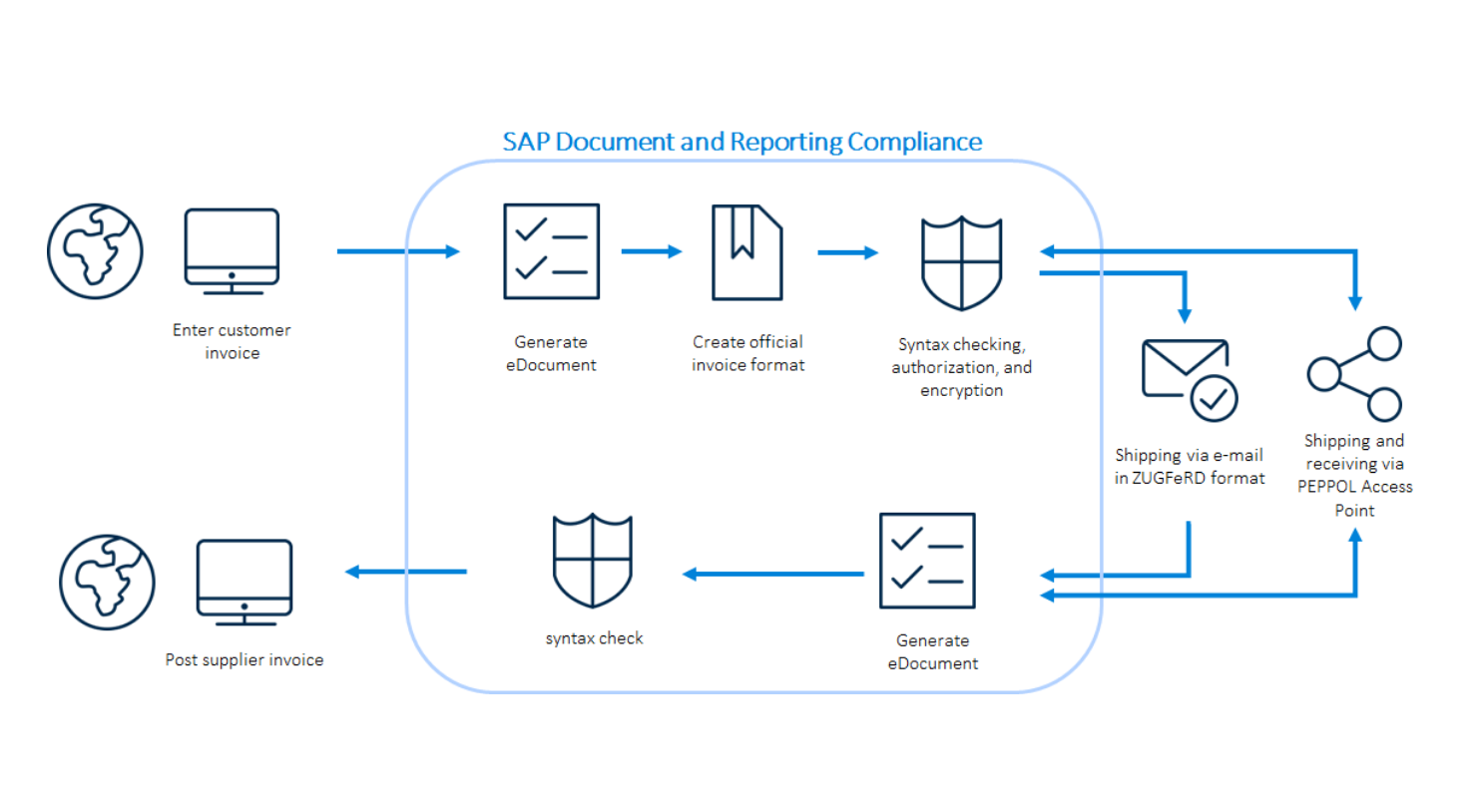

Electronic invoice exchange with SAP DRC optimizes the entire invoicing process. With this solution, companies automatically create e-documents in the official format and ensure that the syntax is validated in accordance with legal requirements. Invoices can be sent flexibly via PEPPOL or email, either manually or automatically, with confirmation of receipt provided for maximum transparency when sent via PEPPOL. Incoming documents are created and checked directly in SAP DRC, enabling seamless posting either manually or integrated into existing workflows.

Why Arvato Systems?

Arvato Systems has many years of experience in the field of SAP Finance & Controlling (FICO) as well as the SD and I-SU modules. This knowledge advantage also flows into our consulting services for the creation of electronically processable invoices. We implement specific customer and industry requirements. If there are any changes to the formats, these are implemented automatically.

Arvato Systems offers a comprehensive service package for the introduction of electronically processable invoices:

- Analysis and development of the infrastructure for the use of XRechnung and ZUGFeRD in a wide variety of system landscapes such as SAP S/4HANA and SAP IS-U or other industry-specific applications

- Advice and support during the introduction of the solution

- Maintenance and support

Your Contacts for SAP S/4HANA Finance