The Target Operating Model in the Finance Department

Resistant to Crises by Using Cloud Technologies

Finance experts may be familiar with this situation: the long-planned workshop with the external consultant on the topic of "Digital Transformation of Finance Processes" as part of an SAP S/4HANA Finance implementation starts with the information that the key players from Controlling, unfortunately, cannot attend. Because of the economic situations and global crises, the outlook for the business situation must be reassessed for the coming months. Ad Hoc request from CFO. No postponement is possible. As is often the case, the knowledge of tapping various data sources, filing the relevant Excel files, and the ability to produce PowerPoint slides suitable for the board of directors seems to be concentrated in the heads of a few employees.

For the responsible manager of the CFO organization from the situation described above, there is at least the prospect of standardizing processes in the future in an intersubjectively comprehensible manner, establishing a single data source as the single point of truth, and also generating reporting quickly and easily through integrated front-end tools.

The Finance Department Should Be in the Driver’s Seat

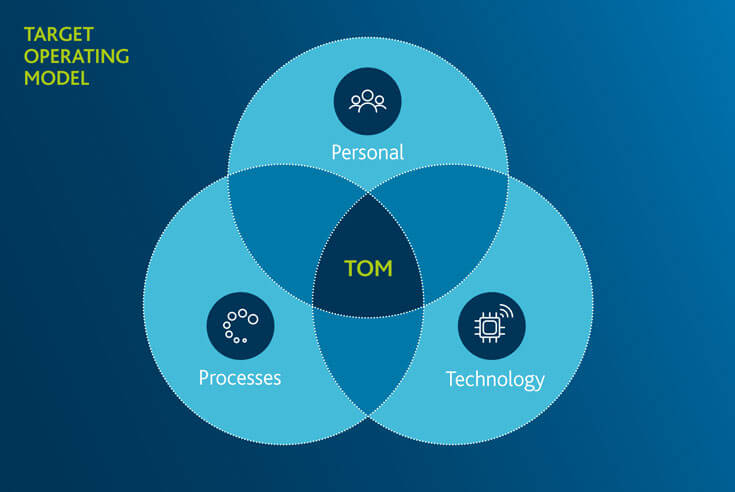

There seems to be a growing consensus among financial experts that, especially in times of crisis, controlling and accounting should defend its interpretive authority in the face of increasing political uncertainties, inflationary tendencies, energy supply bottlenecks, and supply chain problems by interpreting its role more sustainably than before as a business partner. In this context, data must not only be collected and controlled, but rather moderated and embedded into future-oriented control and crisis management recommendations with the help of Artificial Intelligence. The understanding of roles to be defined for this purpose, the required know-how of the employees, the work organization, the basic financial processes and the technological resources should be combined in a target operating model (TOM).

What Is a Target Operating Model (TOM)?

A Target Operating Model (TOM) is a strategic tool that helps companies use variance analysis to compare the gaps between the current state and the actual target state. In terms of finance, it identifies the necessary organizations, processes, and technologies to achieve the desired results. A TOM can also be understood as a roadmap or "statement of direction," which shows the way to efficiently map the tasks of a finance department.

From now on, this target picture represents the guard rails for the finance function or controlling and defines the task focus or the fields of activity of the department on the way from number crunching to the most valuable player. In this context, it should be determined to what extent software-as-a-service products and shared service approaches can deliver added value in the interaction of employees, processes, and technologies.

Investments in Digitization via Cloud-Based Technologies Continue to Take Place

The renowned process benchmarker Hackett Group conducts an annual survey among corporate finance managers to determine the prioritized action topics of the "Finance Agenda". It becomes clear that, based on the 2021 results, the trend toward an accelerated digital transformation of the finance department has intensified again in 2022 in view of crisis scenarios.

With regard to the preferred technology used, a study by FINANCE and F.A.Z. Business Media concludes that the trend toward investment in cloud-based financial applications is unbroken. The current crisis tendencies in particular have once again reduced the reservations in controlling and accounting about the cloud. Thus, 69% of the companies surveyed state that a cloud ERP solution already exists, is planned or is being discussed. There is also consensus that the implementation and operation of such solutions will lead to better scalability, cost savings, and more efficient internal collaboration processes in the long term - and thus contribute positively to a more efficient target operating model for the finance department that is capable of making "better" statements.

Market Data Confirms the Trend Towards Cloud in the Finance Department

The study's statements are also confirmed by current market data. For example, SAP reports a turning point in its own business strategy, as in particular sales of cloud products are growing sustainably even during the crisis because companies are continuing to invest. The figures on the propensity to invest in modern digital working environments in the finance department are doubly significant because many CEOs are obviously assuming negative consequences of the crisis. A global survey of 760 CEOs by the consulting firm E&Y, for example, shows that half of all companies surveyed have already suspended planned investments in their own business model.

Sources

- Weißenberger, B. (2021): Künstliche Intelligenz als Zukunftstechnologie im Controlling, in: Controlling & Management Review

- The Hacket Group: 2022 Finance Agenda: Key Issues to Address and Critical Actions to Succeed

- Finance Magazin: Cloud in der Finanzabteilung

- Handelsblatt: „Wichtiger Wendepunkt erreicht“ – SAP wächst in der Cloud

- WELT: Jedes zweite deutsche Unternehmen musste Investitionen abblasen

Written by

Prof. Dr. Martin Wünsch is an expert in financial reporting and SAP S/4Hana Finance Consulting. He is familiar with this field from various perspectives, e.g., Big4-Audit, Corporate Functions, or Management Consulting. He holds a chair in Business Administration, in particular in Int, Accounting & Controlling, at the FOM University of Applied Sciences Düsseldorf and regularly publishes on current topics in financial reporting.