SAP S/4HANA Finance

Switch Now and Stay One Step Ahead of the Competition

Steering Instead of Observing

Finance is going on the offensive with Digital Finance. The role of the finance department in companies is undergoing rapid change. Whereas it had more of an observing role for a long time, it is increasingly taking on a controlling function.

The focus of CFOs and the finance department will shift "from mainly historical cost control to growth optimization”. This assessment was made in the 2020 study "The CFO of the Future" by the global Association of Chartered Certified Accountants (ACCA) and the Institute of Management Accountants (IMA).

However, this requires a redesign of finance processes, the Digital Transformation of finance. While marketing and sales, warehousing, and logistics have already made great strides in this regard in many companies, finance is often still comparatively at the beginning of this journey.

Demand for Innovative Solutions in the Financial Sector High

Yet the need for innovative solutions and highly efficient processes, especially in finance, is of paramount importance to the competitiveness of modern companies. Here are just three reasons why:

- The complexity of financial processes has increased enormously, for example, due to the multitude of payment methods in e-commerce as well as new business models such as subscription offers for products to be procured on a regular basis.

- In the agile world of modern business, reports on a wide variety of considerations as well as group reporting should be available in real time if possible.

- The finance area should also be set up in a crisis-proof manner and, for example, reflect the realities of the Corona-induced "new normal".

As in all areas of the company, there is thus a great need for optimization, standardization and automation of processes in the finance department. This is not just about efficiency - real-time transparency across the company or group is the goal.

None of this is possible without powerful software systems that break down existing silos, centralize databases, and standardize and automate processes.

SAP S/4HANA Finance

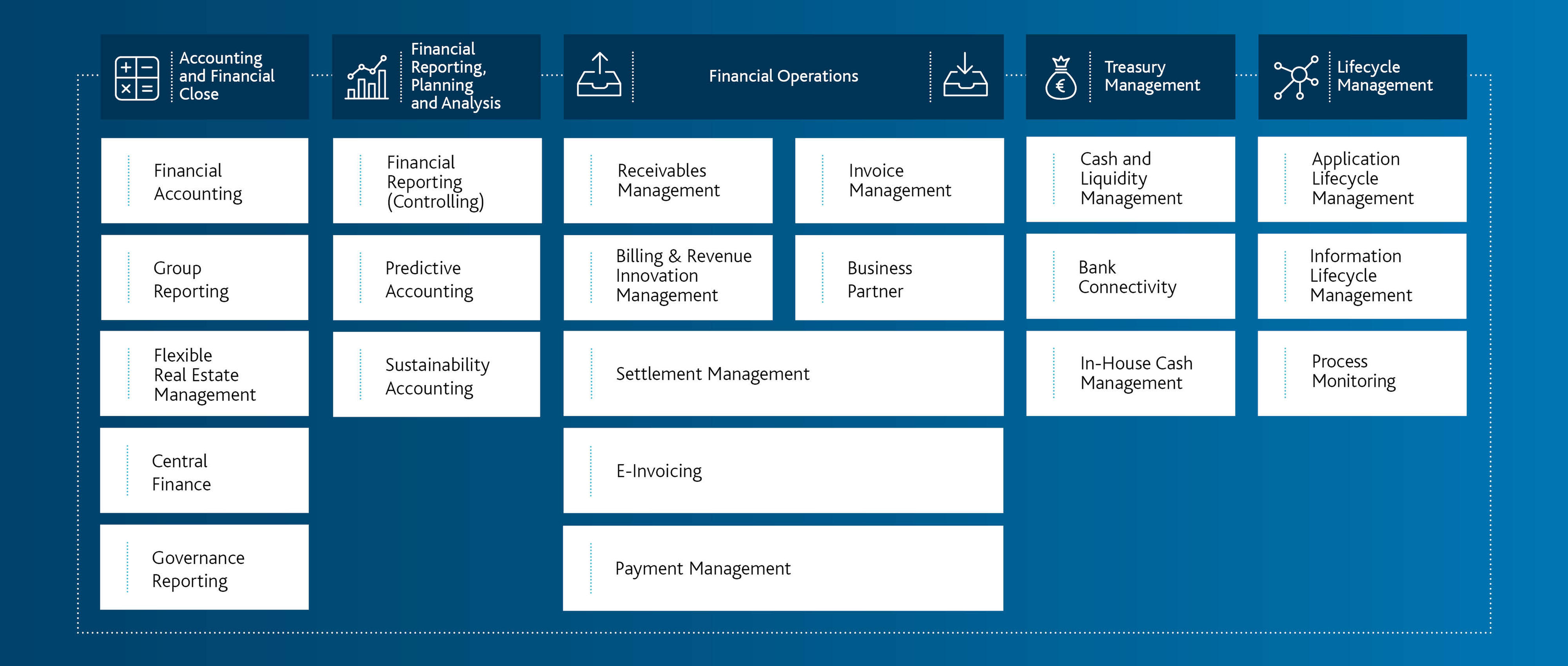

With its S/4HANA ERP system, SAP offers a holistic platform with a broad portfolio of modules for all-encompassing business transformation. The portfolio element S/4HANA Finance and Controlling (SAP FICO) includes financial solutions for accounting, controlling, reporting, and operational management, among others

Functions

From the detailed insights into the current financial situation of the company, appropriate measures can be initiated directly in the SAP system, if required and possible.

-

Universal Journey the “Single Point of Truth”

In addition to an efficient data model, S/4HANA offers high performance even when handling very large data sets - keyword Big Data. Other features include openness for collaboration with other applications and high flexibility for integrating external business partners such as auditors or tax consultants, among others.

The most important aspect for finance departments is probably the Universal Journal. With its introduction, SAP has merged the previously separate areas of financial accounting and controlling. The Universal Journal keeps the data from both areas in a single table and is thus the single point of truth for the data relevant to the finance department.

This means that a wide variety of requirements in the financial area can be efficiently realized - including:

- Fast Close & Continuous Accounting

- Leasing & Revenue Recognition

- Cashflow & Liquidity (Invoice-to-Pay, Invoice-to-Cash, Order-to-Cash)

- Margin Analysis

- Key figures, KPIs & Reporting

- Segments & Management Reporting

- Financial Planning & Analysis

- Integration of Forecasting & Planning

-

Billing & Revenue Innovation Management

New business models are constantly emerging in the economy - current examples are subscription, on-demand and sharing models or the ordering of materials by machines. These require comparatively complex financial processes.

With SAP S/4HANA Finance's Billing & Revenue Innovation Management (BRIM), SAP offers a modular solution that supports such flexible consumption models. It allows the optimization of the corresponding business processes in terms of design, sales, delivery, consumption overview and billing.

SAP BRIM is a combination of a wide variety of software components that are transparently interconnected and can be customized. These include:

- SAP Customer Relation Management

- SAP Convergent Mediation

- SAP Convergent Charging

- SAP Convergent Invoicing

-

Group Reporting

SAP Group Reporting is SAP's strategic tool for the financial reporting of large, mid-sized companies and corporations. The significantly stronger convergence of EPM & Finance requires the breaking down of existing silos in the finance organization. At the same time, this is an essential prerequisite for the optional shift of the operation of EPM applications to the cloud.

SAP Group Reporting combines established programming solutions and modern rule-based logic and thus replaces SEM-BCS, EC-CS, and SAP Financial Consolidation (the maintenance period of these products ends in 2027).

-

SAP Controlling (CO)

SAP Finance provides processes for planning, monitoring and reporting operating costs via SAP CO and thus provides an important basis for optimizing the profitability of a company.

Submodules ensure the reliable handling of all necessary process groups for monitoring & controlling cost elements, cost centers, internal orders and profit centers. In addition, SAP Controlling offers comprehensive functions for profitability analyses and product costing.

-

Financial Planning & Analysis (FP&A)

Financial planning and analysis (FP&A) encompass a collection of planning, forecasting, budgeting, and analysis activities that support an organization's key business decisions and overall financial health. SAP Finance provides all the functionality to enable finance teams to consolidate and analyze financial, operational, and external data - providing the perfect foundation for informed future planning and decision making.

Among other things, SAP Finance helps:

quickly provide accurate financial analysis

forecast the impact of potential decisions on cash flow and the bottom line

assess and monitor the company's overall financial position

create detailed financial models and forecasts

prepare and consolidate budgets across departments

identify and evaluate new revenue opportunities and risks

-

SAP Analytics Cloud

Every day, companies aggregate larger volumes of data. Today, deriving valuable business insights from these masses of data requires a comprehensive and scalable solution - old isolated applications and complicated operation used to stand in the way.

These problems are a thing of the past with SAP Analytics Cloud: It gives you central access to all the data and information you need at any time, supports your teams in their collaboration, and helps them make informed decisions faster.

Highlights of the SAP Analytics Cloud:

- Real-time analytics

- In-memory technology

- Maximum scalability

- Access to all data across devices at any time

- State-of-the-art user interface with highly functional dashboards

- Allows optimal teamwork

The Advantages of SAP S/4HANA Finance

Faster Processes

Through standardization and automation, but especially through the use of the Universal Journal, the paths to consolidated financial data are significantly shortened. The time required for the preparation of financial statements and group closings is significantly reduced.

Higher Flexibility

The system enables the business model to be made more flexible and agility to be increased - both of which make it possible to respond more quickly to changes in circumstances.

Fewer Errors

Activities that were previously carried out manually, for example in closing, are now handled by rule-based automatisms - examples include data upload, IC reconciliation and the creation of reports. The elimination of manual activities minimizes the potential for errors.

Higher Transparency

With the implementation of SAP S/4HANA Finance, previously separate silos in the finance organization grow together. Consolidated financial data becomes transparent and more auditable through Track&Trace. Transparency for audits and the depth of analysis for forecasting and financial management are increased.

Low TCO, Attractive ROI

Implementing SAP S/4HANA Finance is a manageable investment. Thanks to the significant acceleration of processes and the lower total cost of ownership (TCO), an attractive ROI can be presented.

Flexible Platform

Whether a customized private cloud offering from Arvato Systems or a private cloud solution as part of RISE with SAP: You decide which form of operation best suits your strategy.

Our Service Portfolio

As finance and IT experts, we enable you to effectively manage your business with agile and integrated business processes based on SAP S4/HANA Finance, so that you can position your company for the future in a resilient, profitable and sustainable manner. With our comprehensive portfolio of services, we offer you innovative solutions and products up to entire platforms, business process expertise in an end-to-end oriented process consulting and 24/7 support in the area of application management service.

Proven Procedure

Roadmap

Deploying SAP S/4HANA Finance is an essential step towards mapping integrated financial reporting. The right roadmap is the prerequisite for the optimal integration. We support you in the creation of your customized schedule.

Software Factory plus Value Center

We rely on the Software Factory concept for you: consistent global teams of specialists ensure fast, cost-effective and precise implementation using proven tools and methods (including Continual Improvement Process (CIP)).

Consulting

With our Consulting Services, we bundle our financial expertise into a unique, valuable service offering. We support you in optimizing your financial processes and integrating the diverse information in the CFO organization. Our experienced consultants build the bridge between planning, actuals, reporting, and IT for you.

Why Arvato Systems?

Arvato Systems is one of the leading enablers when it comes to comprehensive business transformation based on SAP solutions. As a service provider for our parent company Bertelsmann, we are familiar with the diverse challenges faced by finance departments from our own daily experience - including, for example, the dynamically evolving requirements of stakeholders, the financial markets, and banks and regulators.

Our consultants are both IT and subject matter experts. They listen carefully and translate business requirements into convenient, efficient and secure technological solutions. We do not act as short-term "one spot" consultants or "pop-up" consultants, but are a reliable and continuous companion for our customers throughout the entire SAP Transformation Journey. We think holistically and offer a highly integrated approach on request - in line with the motto "the best of all worlds".

This can also include in-house developments such as Aqount. This is an accounting platform based on SAP S/4HANA that enables the orchestration of the entire processes as part of the business transformation - from risk management and invoice generation to receivables and cash management.

Arvato Systems & SAP S/4HANA - A Dream Team!

In the current ISG Provider Lens™ Quadrant Report Germany 2021, the technology research and consulting firm ISG examined the expertise of IT service providers throughout Germany - and recognized Arvato Systems as the leader in "SAP S/4HANA System Transformation - Midmarket."

Reference in Focus

Together with our customer, we successfully implemented a central commercial platform with SAP S/4HANA Enterprise Management.

SAP S/4HANA Enterprise Management enables the logistics group Imperial Logistics to handle Big Data in a completely new way and puts it in a position to process and analyze very large amounts of data in real time so that the right decisions can be made and opportunities, trends and risks can be identified at an early stage.

Your Contact for SAP S/4HANA Finance